As an iPhone user, you have access to useful financial tools right at your fingertips. One such tool is the Cash App, which allows you to send and receive money instantly between friends and family. What you may not realize is that Cash App also provides an option to borrow money when you’re in a pinch. If you find yourself needing a short-term loan to cover an unexpected expense, the Cash App Borrow feature can provide you access to funds within minutes. By connecting the app to your bank account, you can take out a small loan and pay it back with interest over time. The process is quick, convenient, and can help relieve financial stress when you need it most. In this article, you’ll learn step-by-step how to borrow money through the Cash App on your iPhone.

Introduction to Borrowing Money on Cash App

To borrow money on Cash App, you first need to enable the “Borrow” feature in the app. To do this, open Cash App on your iPhone and tap the profile icon. Select “Borrow” and turn on the toggle next to “Enable Borrowing”. You will need to verify your identity and provide details like your social security number.

Once enabled, you can borrow between $20 to $500 at a time. The specific amount will depend on factors like your payment history and activity in the app. The annual percentage rate (APR) for a Cash App Borrow is typically lower than a credit card. Repayment terms are flexible, ranging from 4 weeks up to 12 months.

To request a loan, open Cash App and tap “Borrow”. Enter the amount you need, between $20 to $500. Cash App will review your request and eligibility criteria like payment history, and approve or deny the loan. If approved, the money will be deposited directly into your Cash App balance within minutes.

You can repay the loan at any time with no prepayment penalty. Payments are deducted automatically from your Cash App balance. If your balance is insufficient, Cash App will keep attempting to deduct payments on the due date. Late or missed payments may result in additional fees. It’s best to pay on time to avoid penalties and protect your credit.

Read also: Top 20 Loan Apps for iPhone in Nigeria

Borrowing on Cash App is meant to be short-term financing for essential expenses. Use it responsibly and pay the money back as agreed to avoid unwanted fees or damage to your credit score. With on-time payments, you can build a good payment history and become eligible for higher loan amounts and better terms. But only borrow what you can afford to pay back.

What Is Cash App?

The Cash App is a popular money transfer service that allows you to send and receive money instantly with friends and family. Developed by Square, Inc., Cash App is available for free on iOS and Android.

To get started, you first need to download the Cash App on your iPhone and create an account. Then, link a debit card, credit card or bank account to transfer money to and from your Cash App balance. Now you are ready to start borrowing money from friends or borrow Cash App.

Step-by-Step Guide to Requesting Money on Cash App

To request money on Cash App, simply follow these steps:

Add a Bank Account

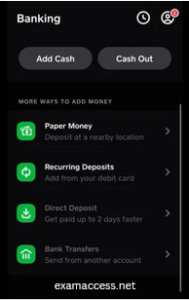

To send or receive money, you’ll first need to link a bank account to your Cash App account. Go to the “Add Bank” option in the app and enter your account information to link your bank account. This process usually takes 2-3 days for verification. Once linked, you can begin requesting and sending payments.

Tap the “Request” Button

- Open the Cash App on your iPhone and tap the “Request” button at the bottom of the screen.

- Enter the amount you want to request and the recipient’s $cashtag or phone number.

- Add an optional note to provide context for your request, then tap “Request” to send.

The Recipient Accepts Your Request

- Your recipient will receive a notification of your request and can review the details.

- If they accept your request, the funds will be deposited directly into your linked bank account, typically within 1 to 3 business days.

Request Status and History

- You can check the status of pending requests by tapping “Activity” in the Cash App menu. Pending requests will show as “Requested.”

- Once a request has been accepted and paid out, its status will update to “Completed.”

- To view your request history, tap the clock icon at the top of the “Activity” screen. You’ll see details of all your sent and received requests.

By following these simple steps, you can easily request money from friends and family right within the Cash App on your iPhone. Let me know if you have any other questions!

Tips for Paying Back Borrowed Money on Cash App

Once you’ve borrowed money through the Cash App, it’s important to pay it back promptly according to the terms you agreed to. Failure to repay the loan can negatively impact your credit and ability to borrow in the future. The following tips will help ensure you pay back your Cash App loan responsibly:

Make a Repayment Schedule

After receiving the funds, create a schedule for repayments that fits within your budget. Determine how much you can afford to pay each week or month, then divide the total amount borrowed by that figure to get the number of payments needed. Add a bit of padding in case of unexpected expenses. Stick to this schedule to avoid late fees or a default on the loan.

Set Up Automatic Payments

If possible, set up automatic payments through the Cash App for at least the minimum due each period. This will ensure on-time payments even if you forget, and can help you pay the loan off faster by making fixed payments. You can adjust or cancel auto-pay at any time through the app. Just be sure to do so before the next scheduled withdrawal to avoid fees.

Pay Extra When You Can

Make additional payments whenever you have extra funds available to pay down the principal faster and save on interest charges. Even small amounts like $10 or $20 here and there can help significantly shorten the life of the loan and reduce the total payoff amount. The faster you can repay the loan, the less it will end up costing you in the long run.

Contact Cash App if Needed

Don’t hesitate to contact Cash App’s customer support if you experience difficulties making payments or have questions about your loan. They may be able to set up an alternate payment plan or temporarily reduce or waive certain fees if you communicate with them regarding your situation. It is always best to be proactive rather than missing payments, as that can hurt your credit and ability to take out future loans.

Following these tips for repaying a Cash App loan in a responsible manner can help ensure a positive outcome and allow you to borrow confidently in the future should the need arise again. Maintaining open communication and sticking to a realistic repayment schedule are key to successfully paying off your loan.

Conclusion

In conclusion, borrowing money via the Cash App on your iPhone is a convenient way to access funds when you need them. By enabling the Cash Card, adding a debit card, and setting your instant transfer limit, you’ve given yourself the ability to borrow money instantly through the Cash App when other options are unavailable. While borrowing money should only be done responsibly and payments made on time, the Cash App provides a useful financial tool for those moments when you need quick access to funds. By following the steps outlined, you now have the knowledge and capability to borrow money through the Cash App on your iPhone should the need arise.

Pingback: Top 5 loan apps in nigeria with low interest rate - Exam access